Understanding the Dynamics of Silver Cost: A Comprehensive Guide

Silver has long been recognized as a valuable asset, both for its industrial applications and as a form of investment. As we delve into the various aspects surrounding the silver cost, you will discover the intricacies that affect its pricing, the factors influencing the market, and strategies to leverage this precious metal effectively.

What Influences Silver Cost?

The cost of silver is not determined by a single factor; rather, it is the result of a complex interplay of multiple elements. Here, we outline the key influencers:

- Supply and Demand: The basic economic principle of supply and demand plays a pivotal role. When demand outpaces supply, prices typically rise.

- Global Economic Climate: Turning points in global economies, such as recessions, can elevate silver prices as investors seek safe-haven assets.

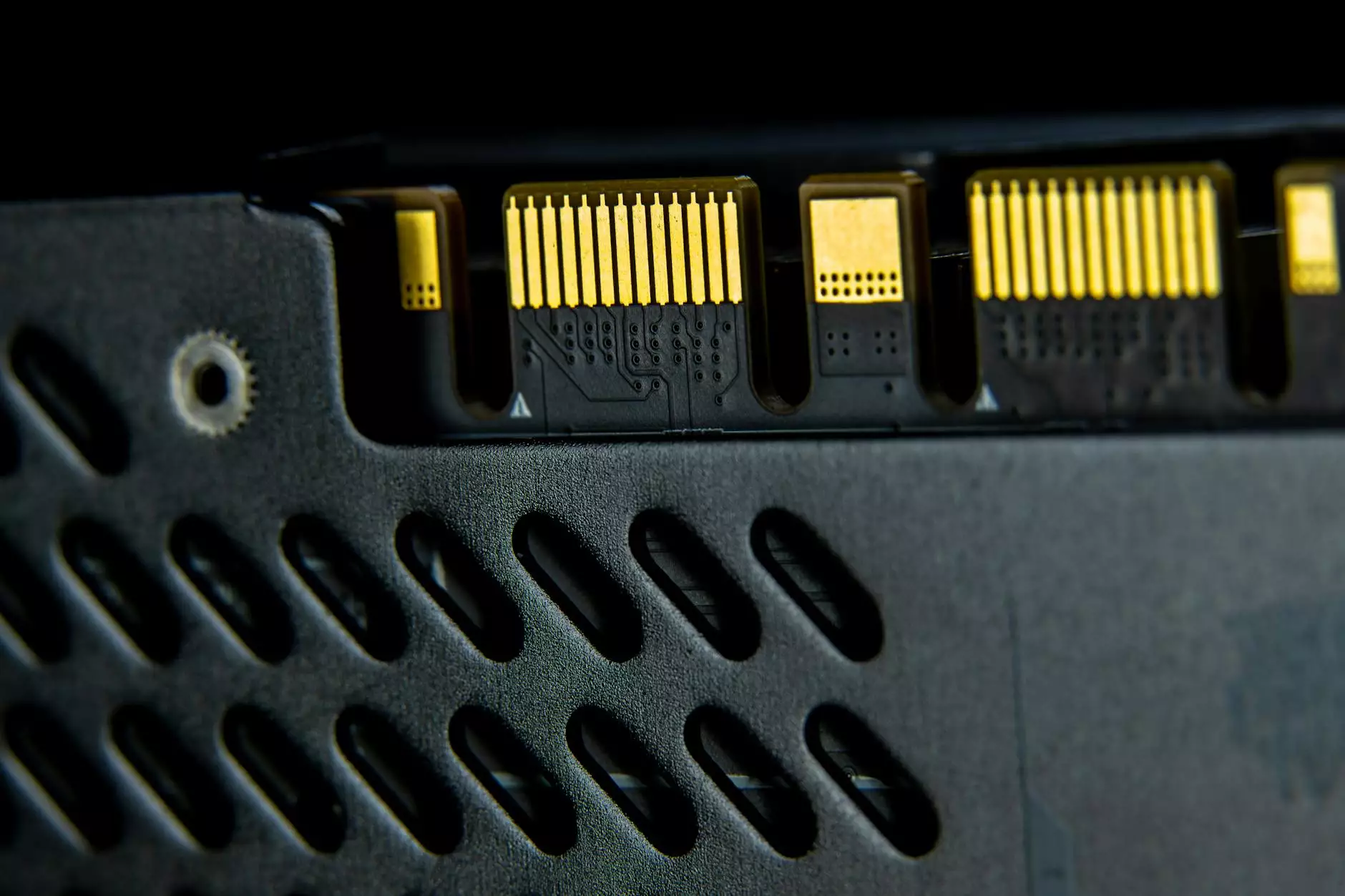

- Technological Advancements: Innovations in technology, particularly in the electronics and renewable energy sectors, have increased demand for silver.

- Geopolitical Events: Political instability or economic sanctions can disrupt supply chains, causing fluctuations in silver costs.

- Currency Strength: Because silver is traded globally, the strength of the US dollar can inversely affect its price; a weaker dollar generally correlates with higher silver costs.

- Interest Rates: Low interest rates can encourage investment in tangible assets like silver, driving up demand and prices.

The Historical Context of Silver Costs

Understanding how the cost of silver has evolved over time provides valuable insights into current trends. Historical events greatly impacted silver pricing:

- The 1980 Silver Bubble: Prices soared to nearly $50 per ounce due to speculation, only to crash shortly after.

- 2008 Financial Crisis: During this economic downturn, silver emerged as a viable alternative investment, causing prices to surge.

- Recent Trends (2020-2023): The pandemic triggered a rush to precious metals, with silver gaining popularity as investors sought security, pushing prices to new highs.

Current Market Trends Affecting Silver Cost

Today’s marketplace presents unique trends that are reshaping the silver cost landscape:

- Increased Demand in Renewable Energy: As nations pivot towards sustainable energy solutions, silver is playing a critical role, particularly in solar panel production.

- Growing Industrial Use: Silver's conductive properties make it essential for various industries, including electronics and medical applications.

- Investment Demand: Silver ETFs and bullion are becoming more popular among investors, further increasing demand and impacting overall cost.

Strategies for Buying Silver Bullion

When investing in silver, understanding pricing strategies is crucial. Here are some effective approaches to consider:

1. Evaluate the Spot Price

The spot price is the current market price at which silver is being bought or sold. Staying updated on the spot price will help you determine when to make your purchase.

2. Monitor Premiums

Premiums are the additional costs above the spot price incurred when buying physical silver. Always compare premiums from various dealers to ensure competitive pricing.

3. Consider Different Types of Silver Products

Silver comes in various forms such as coins, bars, and rounds. Each type may have different premiums associated with them, influencing your overall cost:

- Silver Coins: Often more expensive due to their numismatic value.

- Silver Bars: Generally have lower premiums and are ideal for bulk purchases.

- Silver Rounds: These are similar to coins but are not government issued, often presenting lower premiums.

4. Invest for the Long Term

Investing in silver should be viewed as a long-term strategy. The market can be volatile, but historically, silver maintains its value over time.

The Importance of Understanding Market Sentiment

Market sentiment can significantly influence the cost of silver. This refers to the overall attitude of investors towards silver, which can shift based on various factors:

- Analyst Ratings: Positive or negative ratings from analysts can sway investor confidence and impact demand.

- Social Media Trends: With platforms increasingly influencing investment choices, trends on social media can affect perceptions of silver's viability as an investment.

- Investment Publications: Articles and reports can create hype or concern around silver pricing, leading to swings in the market.

How to Buy Silver Online Safely

If you decide to buy silver bullion, ensuring a safe purchase is paramount. Consider the following tips:

- Choose Reputable Dealers: Always buy from established and trustworthy dealers. Websites like donsbullion.com offer a vast selection of gold, silver, platinum, and palladium bullion.

- Check Reviews: Look for verified customer reviews to gauge the reliability of a dealer.

- Secure Payment Options: Ensure the website provides secure payment methods to protect your financial information.

- Understand Return Policies: Familiarize yourself with the dealer’s return policy before making a purchase.

The Future of Silver Cost

Looking ahead, the cost of silver is expected to be influenced by several ongoing trends:

- Technological Innovations: Advancements in technology may further enhance silver's industrial demand, potentially driving prices upward.

- Sustainable Investment Practices: As investors increasingly seek sustainable and ethical investment avenues, silver's demand could see a rise due to its green applications.

- Global Economic Recovery: A recovering global economy post-pandemic may lead to increased industrial activity, influencing the overall demand for silver.

Conclusion

The silver cost reflects a myriad of factors ranging from economic performance to industrial demand and market sentiment. By understanding these elements and staying informed about market trends, potential investors can make well-informed decisions regarding their silver investments.

At donsbullion.com, we are dedicated to providing you with timely and relevant information about precious metals, including gold, silver, platinum, and palladium bullion for sale. Whether you're a seasoned investor or a newcomer, understanding the intricacies of silver and its cost is crucial to maximizing your investment strategies.